Insurers and policyholders can benefit from a fair claim settlement process in insurance company negotiations. This involves balancing actual repair costs, maintaining policyholder financial stability, considering depreciation, and age of the vehicle. Both parties have contrasting goals but successful outcomes require understanding, communication, empathy, transparency, and prompt dispute resolution. Preparation and strategy, including gathering relevant documents and offering alternative solutions, are key to achieving a fair outcome.

Insurance company negotiations can be complex, with both insurers and policyholders seeking fair outcomes. Understanding what defines a fair settlement is crucial for navigating these discussions effectively. This article delves into the key factors that constitute a just insurance claim resolution, balancing interests, and providing practical strategies for achieving optimal results. By exploring these aspects, individuals can better prepare for negotiations and ensure they receive adequate compensation.

- Understanding Key Factors: What Constitutes a Fair Insurance Claim Settlement?

- Balancing Interests: The Role of Insurers and Policyholders in Negotiations

- Strategies for Achieving Optimal Outcomes: Tips for Effective Insurance Company Negotiations

Understanding Key Factors: What Constitutes a Fair Insurance Claim Settlement?

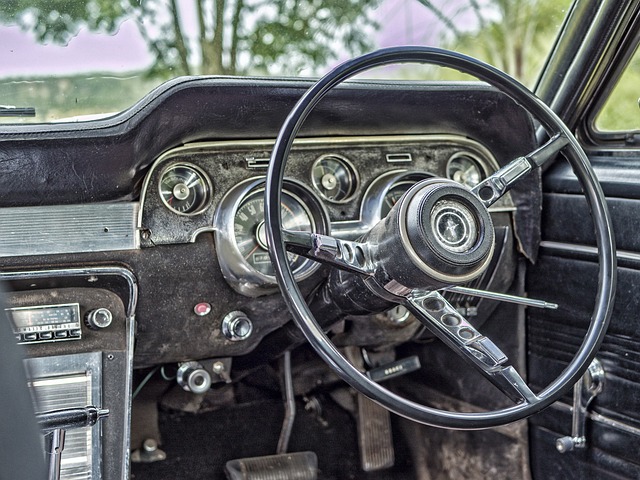

When it comes to insurance company negotiations, defining a fair claim settlement is paramount for both policyholders and insurers. A reasonable outcome should aim to balance several key factors. One of the primary considerations is the actual cost of automotive repair or vehicle bodywork/restoration required. This includes not just the replacement of damaged parts but also labour costs associated with the repairs.

Additionally, the impact on the policyholder’s financial well-being must be taken into account. A fair settlement should leave the claimant in a position comparable to their pre-accident state, ensuring they can effectively cover any additional expenses, such as transportation or alternative accommodation if necessary, without undue strain. This includes consideration of factors like depreciation and the age of the vehicle, which may affect the overall value of the claim.

Balancing Interests: The Role of Insurers and Policyholders in Negotiations

Insurers and policyholders have distinct interests when it comes to insurance company negotiations. Insurers aim to minimize their financial exposure while offering fair compensation, often focusing on assessing risks accurately and adhering to regulatory guidelines. Policyholders, on the other hand, seek adequate reimbursement for their losses, be it a damaged bumper repair, auto bodywork fix, or tire services. Striking a balance between these interests is crucial for reaching a fair negotiation outcome.

A successful negotiation involves both parties understanding each other’s perspectives and finding common ground. Policyholders should clearly communicate their needs and expectations, while insurers must demonstrate empathy and a willingness to resolve issues promptly. This back-and-forth process requires patience, transparency, and a commitment to resolving the dispute in good faith, ultimately leading to an agreement that acknowledges both the company’s financial responsibility and the policyholder’s legitimate claims.

Strategies for Achieving Optimal Outcomes: Tips for Effective Insurance Company Negotiations

Achieving a fair outcome in insurance company negotiations requires a strategic approach. First, prepare thoroughly by gathering all relevant information and documents related to your claim, including estimates for car body restoration or auto repair services from reputable shops. This demonstrates your understanding of the situation and enables you to present a strong case.

During negotiations, remain calm and assertive. Clearly communicate your expectations and be prepared to justify them. Listen actively to the insurance representative’s arguments and address any concerns or discrepancies. Consider offering alternative solutions if the initial demand seems unreasonable. For instance, if discussing car repair services, explore options for cost-effective repairs or replacement parts that align with your budget.

Achieving a fair insurance claim settlement involves a delicate balance between understanding your rights, knowing the key factors that define fairness, and effectively communicating with the insurance company. By recognizing the importance of both insurer and policyholder interests, you can navigate these negotiations successfully. Utilizing strategies like thorough documentation, clear communication, and staying informed about your policy’s terms can lead to an optimal outcome. Remember, insurance company negotiations are a process, requiring patience and persistence to secure the fair compensation you deserve.