Attorneys specializing in insurance company negotiations protect policyholders' rights during collision claim processes. They navigate complex regulations, assess damage, and leverage evidence to secure favorable outcomes. By reviewing policies, identifying loopholes, and using legal precedents, these attorneys advocate for clients' interests, ensuring fair compensation for vehicle repairs, from minor to major damage.

Insurance company negotiations are a complex landscape navigated by attorneys, playing a pivotal role in securing favorable outcomes for policyholders. This article delves into the multifaceted roles lawyers play during these discussions, exploring key strategies and legal expertise. From understanding intricate policy provisions to negotiating claims, their guidance is essential. Discover how attorney tactics influence settlements, ensuring policyholders receive just compensation. By examining these negotiation dynamics, individuals can better appreciate the value attorneys bring when interacting with insurance companies.

- Understanding Insurance Negotiation Roles

- Strategies Used by Attorneys in Claims

- Legal Expertise in Policy Drafting & Review

Understanding Insurance Negotiation Roles

In insurance company negotiations, attorneys play a pivotal role in representing policyholders and ensuring they receive fair compensation for claims, including those related to vehicle collisions. These legal professionals have an in-depth understanding of both the law and the insurance industry, which is crucial when advocating for clients’ rights. They navigate complex regulatory frameworks and policies, especially during negotiations involving collision center repairs or vehicle collision repair processes.

Attorneys break down intricate details, such as assessing damage from a collision, understanding the scope of coverage, and calculating potential reimbursement amounts. Their expertise helps in mediating disputes between policyholders and insurance providers, particularly when dealing with disagreements over the cost of collision damage repair. This specialized knowledge is vital for achieving favorable outcomes, ensuring clients receive accurate settlements, and upholding their interests throughout the negotiation process.

Strategies Used by Attorneys in Claims

Attorneys playing a pivotal role in insurance company negotiations employ a range of strategies to ensure their clients’ interests are protected. One common approach is to thoroughly review and analyze the policy terms, conditions, and exclusions relevant to the claim. This meticulous process helps them identify potential loopholes or areas where the insurance company might be inclined to reduce compensation. By understanding these nuances, attorneys can effectively navigate the negotiation process.

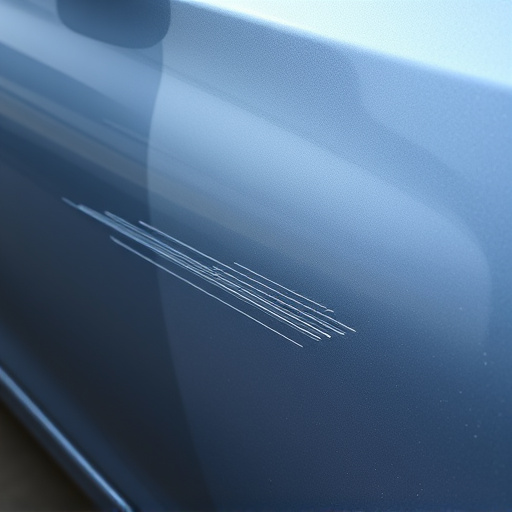

Moreover, legal professionals often focus on presenting compelling evidence supporting their client’s claim. In cases involving auto body services or automotive body work, for instance, detailed estimates, before-and-after photographs, and expert opinions from certified mechanics can significantly strengthen the argument. Additionally, they may leverage legal precedents and case histories to demonstrate successful outcomes in similar claims, adding weight to their position during negotiations with insurance companies.

Legal Expertise in Policy Drafting & Review

Attorneys play a pivotal role in insurance company negotiations, bringing invaluable legal expertise to the table. They possess a deep understanding of policy language and terminology, which is essential when navigating complex insurance contracts. During negotiations, attorneys carefully review and analyze the policies, ensuring that their clients’ interests are protected. This includes scrutinizing terms related to coverage limits, deductibles, and exclusions, among others. By doing so, they can help prevent unfair practices and ensure clients receive fair compensation for any claims, including those involving scratch repair or collision damage repair at a trusted collision center.

Insurers often draft policies with nuanced language that might favor their interests. Legal professionals are adept at identifying such clauses and advocating for more favorable terms. They have the knowledge to explain rights and obligations under the policy, empowering clients to make informed decisions during negotiations. This expertise can prove invaluable in situations where clients need assistance for repairs, whether it’s a minor scratch repair or major collision damage, ensuring they receive appropriate compensation for their troubles.

Insurance company negotiations are a complex landscape where legal expertise plays a pivotal role. Attorneys serve as crucial navigators, utilizing strategies that range from policy drafting and review to claims management. Their deep understanding of insurance regulations and practices ensures clients’ rights are protected. By leveraging this knowledge, attorneys can effectively advocate for fair settlements, making them indispensable in the negotiation process.