Strategic navigation of insurance company negotiations involves preparation, clear communication, and strategic counteroffers to secure better terms. Researching average repair costs and industry standards empowers individuals to confidently discuss claims, validate their estimates, and potentially lower premiums through proactive communication with insurers.

Uncover the power of prompt insurance negotiations and transform your coverage experience. This comprehensive guide, “Demystifying Insurance Company Negotiations,” equips you with the knowledge to navigate conversations confidently. Learn effective strategies in “The Art of Securing Better Terms” and unlock savings potential in “Maximizing Savings.” Take control of your insurance policy by understanding how proactive dialogue can lead to better terms and reduced premiums, empowering you to make informed decisions.

- Demystifying Insurance Company Negotiations: A Comprehensive Guide

- The Art of Securing Better Terms: Tips for Effective Negotiation

- Maximizing Savings: Strategies to Lower Insurance Premiums Through Dialogue

Demystifying Insurance Company Negotiations: A Comprehensive Guide

Many people approach insurance company negotiations with a sense of trepidation, viewing them as complex and often confusing processes. However, demystifying these conversations is key to securing the best possible outcome. Insurance companies, while aiming to protect their interests, are also looking for mutually beneficial agreements. Understanding their motivations can help you navigate these talks effectively.

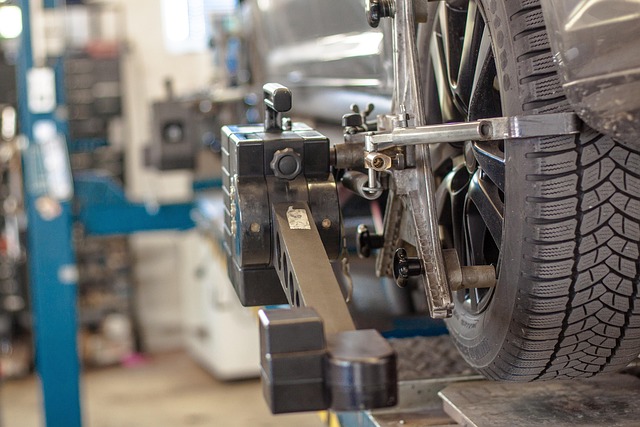

A comprehensive guide to insurance company negotiations involves preparing thoroughly. Researching common repair costs, such as those for a bumper repair or car body restoration, empowers you to set realistic expectations. Knowing the average price range for auto maintenance services demonstrates your knowledge and commitment to fair practices. During discussions, focus on clear communication, highlighting the benefits of swift repairs and their impact on future claims. Emphasize that prompt insurance negotiations lead to smoother processes, faster claim resolutions, and ultimately, cost savings for both parties.

The Art of Securing Better Terms: Tips for Effective Negotiation

Negotiating with an insurance company can seem daunting, but understanding the art of securing better terms is a valuable skill. The key lies in preparation and knowing your worth. Before entering into any conversation, research industry standards for similar claims to gauge reasonable settlement amounts. This knowledge empowers you during discussions, allowing you to advocate for yourself effectively.

When negotiating, focus on clear communication. Present your case calmly and confidently, supporting your position with facts and figures. Highlight the quality of auto repair services or collision repair shop estimates to validate your claim’s integrity. Remember, insurance companies aim to settle quickly, so be prepared to counter their initial offers and walk away if necessary. This strategic approach ensures you secure favorable terms for your insurance company negotiations while ensuring your interests are protected, especially when it comes to essential auto maintenance costs.

Maximizing Savings: Strategies to Lower Insurance Premiums Through Dialogue

Understanding how to navigate insurance company negotiations can significantly impact your bottom line when it comes to managing unexpected events like a fender bender. Maximizing savings starts with proactive communication. Engaging in dialogue allows policyholders to express their needs and concerns, which can lead to more personalized coverage options tailored to individual circumstances.

By initiating conversations with insurers, individuals can uncover strategies to lower insurance premiums. This may involve discussing bundling policies, negotiating rates based on safe driving practices, or exploring discounts for maintaining a clean driving record. For instance, if you’ve been involved in minor collisions and have a history of repairs at an auto body shop, your insurer might offer opportunities to reduce costs by ensuring comprehensive coverage aligns with your vehicle’s needs and your driving habits.

Understanding and participating actively in insurance company negotiations can be a game-changer, allowing you to secure better terms and maximize savings on your premiums. By demystifying the process and employing effective negotiation strategies, as outlined in this guide, you can navigate these conversations with confidence. Remember that knowledge is power when it comes to insurance company negotiations, empowering you to make informed decisions that protect your interests and wallet.