Insurance company negotiations for luxury vehicle repairs can be complex. Policyholders should understand tactics like downplaying damage severity and gather comprehensive documentation to challenge underestimated assessments. By asking detailed questions about hidden costs, labor fees, and parts markup, individuals can ensure fair compensation for all necessary repairs, including car body restoration. Empowering oneself with knowledge of rights, the claim process, and pre/post-damage vehicle valuation is key to navigating negotiations effectively and protecting interests throughout the claims process.

In the intricate dance of insurance company negotiations, understanding the unspoken tactics is as crucial as mastering the art of communication. This article unravels the mysteries behind what your adjuster might leave unsaid, empowering you with insights into their negotiation strategies. From recognizing hidden costs in claim settlements to equipping yourself for a successful claims process, gain valuable knowledge to navigate these conversations effectively.

- Understanding Insurance Company Negotiation Tactics

- Uncovering Hidden Costs in Claim Settlements

- Empowering Yourself During The Claims Process

Understanding Insurance Company Negotiation Tactics

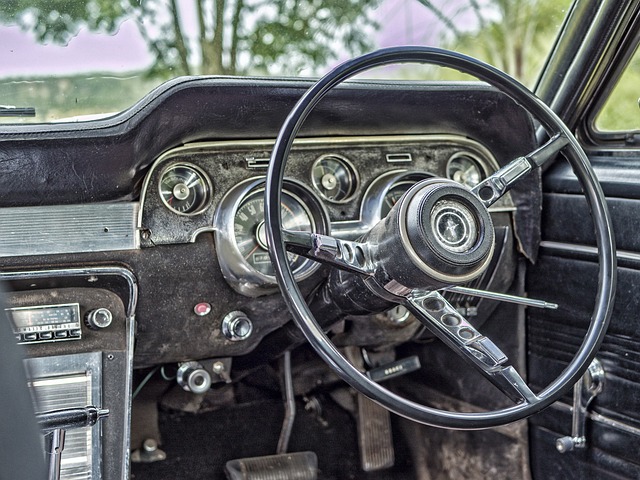

Insurance company negotiations can be a complex dance, especially when it comes to claims involving high-value items like luxury vehicles. These companies employ various tactics to manage costs and maintain profit margins. One common strategy is to downplay the severity of damages, often encouraging policyholders to accept lower settlements than what their repairs actually cost. For instance, in cases of automotive restoration or car paint services, adjusters might minimize the scope of work required, leading owners to believe their vehicles will be restored at a fraction of the actual cost.

Understanding these negotiation tactics is crucial for policyholders. When dealing with a claim for a luxury vehicle repair, it’s important to gather comprehensive documentation and expert opinions to challenge any underestimated assessments. Being informed about insurance company negotiations empowers individuals to protect their interests, ensuring they receive fair compensation for the necessary repairs, whether it involves intricate automotive restoration or meticulous car paint services.

Uncovering Hidden Costs in Claim Settlements

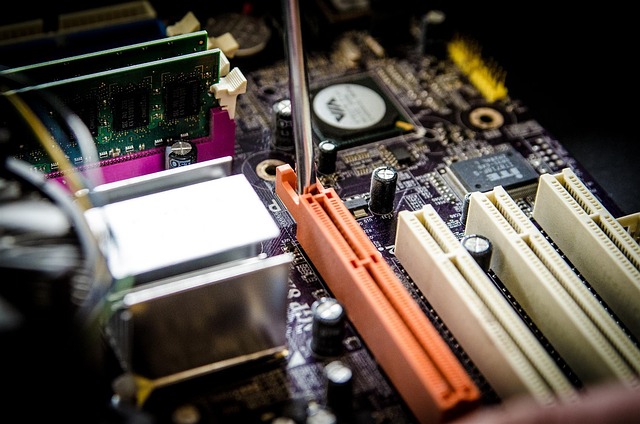

When engaging in insurance company negotiations for your car repairs after an accident, it’s easy to focus solely on the immediate, visible damages—the cracked windshield, dented fender, or scrapes on the side of your vehicle. However, one area that often goes unnoticed is uncovering hidden costs within claim settlements. Beyond the obvious repairs like a fender repair or collision repair services, there are various additional expenses associated with car bodywork that insurers may not readily disclose.

These can include hidden fees for labor, parts markup, and even incidental costs like rental car expenses during the repair period. It’s crucial to ask detailed questions about each component of your claim settlement, ensuring transparency from the adjuster. By being proactive in understanding these hidden costs, policyholders can make informed decisions, receive accurate quotes, and ultimately avoid unexpected financial surprises when it comes to their car bodywork repairs.

Empowering Yourself During The Claims Process

Empowering yourself during the claims process is crucial when navigating insurance company negotiations. Understand that you have rights and a say in the outcome of your claim. Familiarize yourself with the process, including the value of your vehicle before and after damages, to ensure accurate compensation. This knowledge allows you to initiate conversations with your adjuster, discussing repairs like car body restoration or even exploring alternative solutions if traditional car repair services aren’t feasible.

Don’t be afraid to ask questions about their assessment and request detailed explanations. The goal is to reach a fair settlement that covers not just the immediate costs but also potential future expenses related to your vehicle’s upkeep. By being proactive and well-informed, you can navigate these negotiations with confidence, ensuring that your interests are represented throughout the claims process.

Understanding the tactics employed by insurance companies during negotiations is a powerful tool for any claimant. By recognizing hidden costs and empowering yourself with knowledge, you can navigate the claims process confidently. Remember, informed decisions lead to fairer settlements, ensuring you receive the compensation you deserve for your claim. Stay diligent, and don’t be afraid to challenge practices that seem unfair – your perseverance could make a significant difference in future insurance company negotiations.