To master insurance company negotiations for vehicle collision repairs, examine repair estimates beyond immediate costs to uncover hidden fees. Prepare strategically with estimates from reputable shops, communicate clearly, and avoid quick settlements. Understand adjuster tactics, prepare comprehensive documentation, know your rights and policies to advocate for fair compensation.

“Uncover the secrets behind successful insurance company negotiations with our comprehensive guide. Many adjusters omit crucial details that can significantly impact your claim’s settlement. Learn how to identify and challenge hidden costs, employ powerful strategies to strengthen your case, and navigate potential loopholes. Armed with this knowledge, you’ll confidently advocate for yourself throughout the claims process, ensuring a fair outcome.”

- Uncovering Hidden Costs in Insurance Claims

- Strategies to Win Your Case: What They Don't Teach You

- Navigating Loopholes: How to Stand Up for Yourself

Uncovering Hidden Costs in Insurance Claims

In the midst of insurance company negotiations, it’s easy to focus solely on the direct costs of repairs. However, savvy claimants should look beyond what’s immediately apparent. Many automotive body shop and vehicle collision repair bills include hidden fees that can significantly impact the overall cost. From surcharges for specific services like auto glass repair to unexpected expenses related to parts or labor, these hidden costs can catch individuals off guard.

By digging deeper into the details of the estimated repairs, you may uncover elements that contribute to a higher price tag. This proactive approach ensures you’re not only negotiating the visible costs but also navigating potential surprises. Knowing what to look out for—whether it’s an intricate process like auto glass repair or other specialized services—empowers you during discussions with the insurance company, ultimately leading to a fairer settlement.

Strategies to Win Your Case: What They Don't Teach You

When it comes to insurance company negotiations, many individuals are at a loss for what to do or say to win their case. What they don’t teach you is that negotiating with an insurance adjuster is an art that requires a strategic approach. The first step is to gather all necessary information and documents related to your claim, including estimates from reputable auto body repair shops, especially those offering high-quality car paint services. This ensures you have concrete evidence to support your desired repair scope.

Another effective strategy is to communicate clearly and assertively. While adjusters may try to steer conversations towards a quick settlement, stay focused on the details of your case. Present your estimates and explain why the proposed repairs, including automotive collision repair and auto body repair, are necessary. Be prepared to answer questions but also ask for clarification when needed. Remember, you’re not just negotiating a number; you’re advocating for the quality and safety of your vehicle’s restoration after an accident.

Navigating Loopholes: How to Stand Up for Yourself

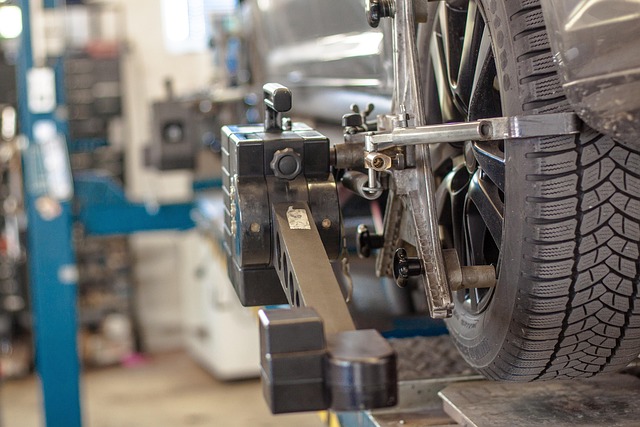

When engaging in insurance company negotiations, understanding how to navigate loopholes is a powerful tool for advocating for yourself. Adjusters often use complex language and technicalities to sway discussions in their favor. They might try to minimize or deny claims related to hail damage repair, auto glass replacement, or car body shop repairs, citing various policy exclusions or interpretation differences. To counter this, be prepared with detailed documentation—photos, reports, and receipts—to support every claim.

Know your rights and policies inside out. Familiarize yourself with the fine print and common loopholes insurance companies use. By staying informed and presenting your case confidently, you can ensure that you receive fair compensation for the necessary repairs. Remember, standing up for yourself is crucial in these negotiations to get the best possible outcome.

Understanding what your adjuster isn’t saying is a powerful tool in navigating insurance company negotiations. By uncovering hidden costs, employing effective strategies, and learning to identify loopholes, you can confidently advocate for yourself throughout the claims process. Remember, being informed and proactive are key to securing fair compensation and ensuring a smoother journey during challenging times.