Policyholders should align expectations with insurers' primary goals of risk mitigation and fair compensation during insurance company negotiations, achieving this through clear communication, detailed documentation, accurate damage assessments, comprehensive estimates from specialists, and evidence of comparable past claims. Insurers assess historical data, incident details, and potential future losses to determine policy terms, balancing financial health with policyholder needs for mutually beneficial outcomes. They conduct thorough evaluations considering structural integrity, cost-effectiveness, claim history, and shop reputation to ensure fairness in the negotiation process.

Insurers’ expectations play a pivotal role in successful insurance company negotiations. This article delves into the core elements that underpin these discussions, focusing on risk assessment as a foundational pillar and key factors insurers scrutinize when evaluating claims. We explore effective communication strategies, including data preparation, policy understanding, and rapport building.

Additionally, we dissect negotiation tactics proven to yield favorable outcomes, while highlighting common pitfalls like overlooking details or missing deadlines, providing insights crucial for navigating these complex conversations.

- Understanding the Expectations of Insurers

- – The role of risk assessment in insurance company negotiations

- – Key factors insurers consider when evaluating claims

Understanding the Expectations of Insurers

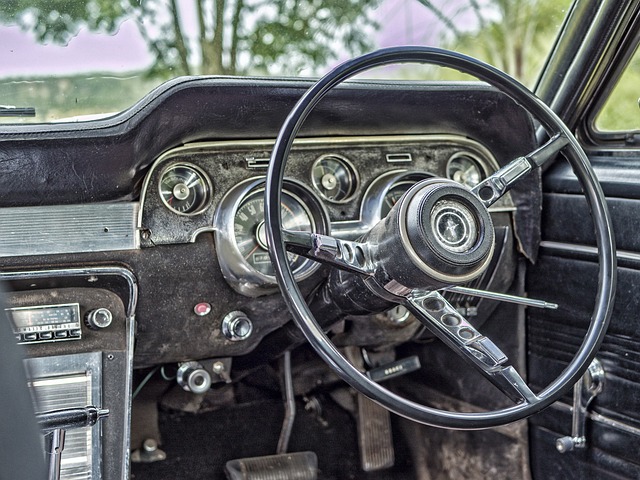

When engaging in insurance company negotiations, understanding the expectations of insurers is paramount for a successful outcome. Insurers are primarily focused on mitigating risk and ensuring fair compensation. During negotiations, they expect clear communication from policyholders about the incident, detailed documentation supporting claims, and accurate assessments of damage. For instance, when discussing repairs, it’s crucial to present estimates not just from car paint services but also from reputable frame straightening specialists, demonstrating a comprehensive understanding of the necessary work.

Insurers also anticipate reasonable demands that align with typical repair costs for similar vehicles and damages. Presenting evidence of past claims or comparable cases can help establish reasonable expectations. For example, if a policyholder is claiming for car dent repair, providing examples of successful repairs and cost breakdowns from previous incidents can build trust and demonstrate an understanding of the insurer’s appraisal process.

– The role of risk assessment in insurance company negotiations

In insurance company negotiations, risk assessment plays a pivotal role in determining the course and outcome of discussions. Before entering into any agreement, insurers meticulously evaluate various factors to gauge the potential risks associated with the claim or policy. This process involves analyzing historical data, understanding the circumstances surrounding the incident (such as a car collision), and assessing the likelihood and severity of future losses related to both personal injuries and material damages, like autobody repairs or car paint services.

By conducting thorough risk assessments, insurance companies can make informed decisions about coverage, pricing, and policy terms. These evaluations ensure that the negotiations are fair and aligned with the company’s financial interests while also meeting the needs of the policyholder. In the context of insurance company negotiations, understanding and managing risks is key to reaching mutually beneficial agreements.

– Key factors insurers consider when evaluating claims

When negotiating with insurance companies, understanding what factors insurers weigh heavily is paramount for policyholders seeking claims settlement. Beyond the apparent damage, insurers scrutinize several key aspects to determine the validity and extent of a claim. For instance, in the case of car bodywork repairs, assessors evaluate the type and severity of the damage, checking for structural integrity and the cost-effectiveness of replacement parts. They might also consider the policyholder’s previous claims history and the reputation of the automotive body shop where repairs are to be done.

Insurers aim to balance their financial obligations with maintaining the integrity of their operations. Therefore, they assess not just the visible repairs needed for a car scratch repair or more extensive damage, but also indirect factors such as the policyholder’s cooperation during the claims process and the potential for fraud. This comprehensive evaluation ensures that settlements are fair while mitigating risks for both the insured and the insurance company in insurance company negotiations.

Insurers approach negotiations with a meticulous understanding of risk assessment and a thorough evaluation of claims. They expect a comprehensive analysis of potential risks, including historical data and predictive trends, to make informed decisions. During negotiations, insurers carefully consider various factors such as claim frequency, severity, and the insured’s overall risk profile. By assessing these elements, they ensure fair pricing and accurate coverage, ultimately fostering transparent and successful insurance company negotiations.