Insurance company negotiations for auto claims require strategic preparation, understanding damage extent, and transparent communication. Balancing competing interests, gathering evidence, maintaining professionalism, and seeking advice from advocates can lead to fair outcomes, ensuring policyholders receive appropriate compensation for vehicle repairs, from minor dents to significant collision damages.

In the intricate world of insurance claims, achieving a fair negotiation outcome is paramount for both insurers and policyholders. This article delves into the defining factors of successful insurance company negotiations, focusing on key elements that foster fairness. By understanding the delicate balance between insurer interests, policyholder rights, and the pursuit of equity, individuals can navigate these conversations effectively. Discover practical strategies to achieve favorable settlement outcomes, empowering you with insights for more just insurance interactions.

- Understanding Key Factors in Insurance Claims Negotiations

- Balancing Interests: Insurer, Policyholder, and Fairness

- Strategies for Achieving Favorable Settlement Outcomes

Understanding Key Factors in Insurance Claims Negotiations

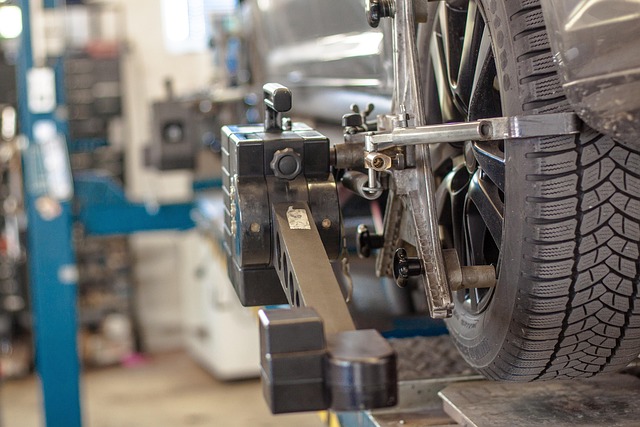

Insurance company negotiations can be complex, with several key factors influencing the outcome. Firstly, understanding the extent of damage and the cost of repairs is crucial—this includes assessing the need for auto maintenance or dent repair, especially in cases of collisions. A thorough evaluation ensures that both parties have a clear picture of the financial implications.

Secondly, communication plays a significant role; effective negotiation requires transparent dialogue between the insured and the insurance company. This process involves discussing not just collision repair center costs but also the timeline for repairs, deductibles, and any potential discounts or coverage limitations. Being prepared with all relevant information and documents is essential to achieving a fair outcome.

Balancing Interests: Insurer, Policyholder, and Fairness

In insurance company negotiations, achieving a fair outcome requires a delicate balance between the interests of the insurer, policyholder, and the pursuit of fairness. At its core, fairness dictates that both parties should be treated equitably, with their respective needs and concerns acknowledged and addressed. For policyholders, this often translates into ensuring their claims for damages, such as in cases of car dent repair or collision repair, are adequately compensated to restore their vehicle to pre-accident condition. Meanwhile, insurers must consider their financial sustainability while adhering to contractual obligations and regulatory standards.

Finding this balance involves open communication, transparency, and a willingness to understand each party’s perspective. In the context of car restoration, for instance, an insurer might need to assess not only the cost of repair but also the potential residual value of the vehicle post-repair. Policyholders, on the other hand, should provide accurate information about the extent of damage and collaborate with insurers to select qualified collision repair shops. This collaborative approach fosters trust and facilitates a negotiation process that prioritizes fairness, ultimately leading to mutually agreeable outcomes in cases like car dent repair or more extensive collision repair.

Strategies for Achieving Favorable Settlement Outcomes

Achieving a favorable outcome in insurance company negotiations requires a strategic approach and a deep understanding of your rights as a policyholder. One key strategy is to be well-prepared, which includes gathering all necessary evidence, such as photographs of damages (for instances, car bodywork services or classic car restoration), repair estimates, and medical records if applicable. This preparation allows for confident and informed discussions with the insurance adjuster.

Another effective tactic is to remain calm and professional throughout the negotiation process. It’s crucial to communicate your needs clearly and assertively without becoming confrontational. Consider seeking advice from an experienced claims advocate or attorney who can provide guidance tailored to your specific situation, ensuring you receive fair compensation for any car scratch repair or other related damages. This proactive approach can significantly impact the final settlement outcome.

Insurers, policyholders, and fairness are interconnected elements that define a fair insurance company negotiation outcome. By understanding key factors, balancing interests, and employing effective strategies, both parties can achieve mutually beneficial settlements. In today’s digital era, navigating these negotiations with transparency and empathy ensures a more robust and harmonious relationship between insurers and policyholders.