Insurance company negotiations pose a challenge for body shops, but by understanding insurers' goals of risk management and cost containment, shops can strategically adapt. Factoring in fault determination, damage severity, and repair facility reputation, body shops can enhance their negotiation outcomes. Demonstrating automotive expertise, providing precise estimates, and building positive relationships with insurers leads to trust-building and mutually beneficial agreements. This approach streamlines processes, expedites turnaround times for auto frame repair and other services, and strengthens the overall insurance claim experience.

In the dynamic realm of auto body shop operations, effective negotiations with insurance companies are paramount for achieving fair compensation and maintaining profitability. This article guides body shops through the intricate process of insurance company negotiations, offering insights into understanding the dynamics, employing powerful strategies, and securing favorable outcomes. By exploring key players, essential tools, and post-negotiation follow-up, shops can master their approach to these discussions, ensuring they receive adequate reimbursement for quality repairs.

- Understanding Insurance Company Negotiation Dynamics

- – The nature of insurance company negotiations

- – Key players and their roles in the process

Understanding Insurance Company Negotiation Dynamics

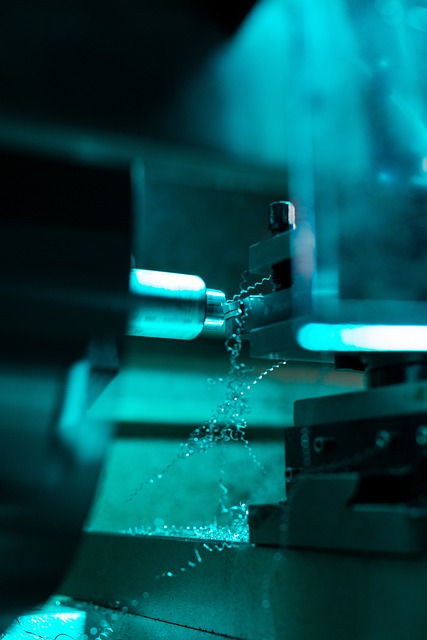

Insurance company negotiations can be a complex landscape for body shops to navigate. To succeed, shops must understand that insurers are primarily focused on risk management and cost containment. Every claim is evaluated based on factors like fault, severity of damage (from minor fender benders to extensive auto frame repair), and the reputation of the repair facility.

By recognizing these dynamics, body shops can tailor their approach. Demonstrating expertise in auto maintenance and vehicle body repair, ensuring precise estimates, and building a positive track record with insurers will foster more productive negotiations. Effective communication, transparency regarding repair methods, and adherence to industry standards are key to building trust and securing favorable terms for both parties involved—ultimately leading to smoother processes and quicker turnaround times for clients needing auto frame repair or other services.

– The nature of insurance company negotiations

Insurance company negotiations are a complex dance, where each move is calculated to secure the best outcome for all parties involved. When engaging with an insurance company, whether it’s regarding claims for auto painting, car bodywork, or collision repair, understanding their negotiation strategies is key. These companies often aim to minimize costs, so they may offer initial estimates that are lower than expected. A skilled negotiator in a collision repair shop wouldn’t accept these first figures but would instead delve into the specifics, questioning every detail to uncover potential hidden costs and ensure the best possible compensation for the services rendered.

The art of negotiation lies in presenting a compelling case, backed by evidence and expertise. Collision repair professionals should be prepared with detailed estimates, industry standards, and comparable cases to argue for fair reimbursement. By staying informed about market rates for auto painting and bodywork services, they can effectively counter any attempts to devalue their work. This strategic approach ensures that the collision repair shop receives adequate compensation for its services while also maintaining a professional and respectful relationship with insurance companies.

– Key players and their roles in the process

In the dynamic landscape of insurance company negotiations, several key players orchestrate the intricate dance of car repair services and auto body painting. The process begins with the insured individual or entity, who, after an accident or damage, seeks compensation from their insurance provider. Acting as intermediaries, insurance adjusters play a pivotal role in evaluating claims, ensuring fair assessment, and facilitating negotiations. They are supported by their company’s legal team, who provide expertise in contract law and policy interpretations.

Additionally, automotive body shops emerge as crucial participants. These facilities, specializing in auto body painting and repair services, not only serve as service providers but also as strategic partners in the negotiation process. Skilled shop managers and technicians collaborate with insurance adjusters to accurately assess damage, propose restoration plans, and ultimately, ensure customer satisfaction while adhering to policy guidelines. This collaborative approach streamlines the claims process, fostering a harmonious relationship between insurance companies, body shops, and their valued clients.

In navigating complex insurance company negotiations, understanding the dynamics and roles of key players is paramount. By grasping the intricacies of these conversations, body shops can strategically approach settlements, ensuring fair compensation for their services. Effective communication, thorough documentation, and a deep knowledge of industry standards are essential tools for successful negotiations with insurance companies, ultimately fostering mutually beneficial agreements.