The insurance company negotiations process is crucial for resolving auto claims, especially for repairs like painting. Policyholders and insurers discuss compensation based on detailed claims and estimates verified against policy terms. Effective communication ensures fair payment for necessary services, with key players including claimants, insurance providers, and vehicle damage assessors. Negotiators review claim validity and severity, consulting experts to appraise restoration costs fairly according to policy agreements.

Unraveling the intricate process of insurance company negotiations is crucial for policyholders seeking fair compensation. This comprehensive guide explores the step-by-step journey, from initial claim submission to potential legal battles. We dissect the key players, goals, and strategies involved in these discussions. Understanding the negotiation dynamics equips individuals with the knowledge to navigate complexities, ensuring their rights are protected and they receive adequate settlements. Discover the art of effective communication, evidence presentation, and policy interpretation for successful outcomes in insurance claim negotiations.

- Understanding the Insurance Company Negotiations Process

- – What happens during insurance company negotiations?

- – Key players involved in the negotiations process.

Understanding the Insurance Company Negotiations Process

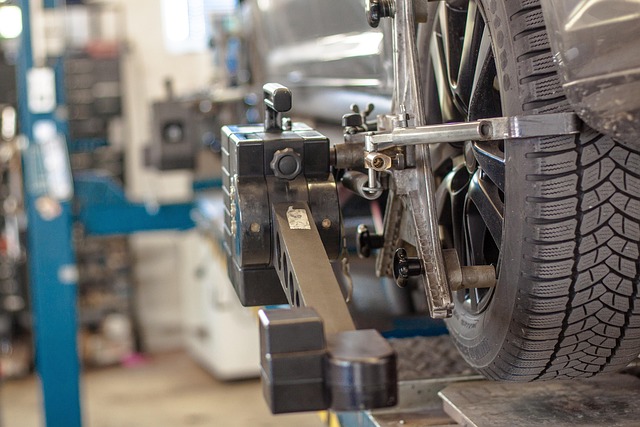

The insurance company negotiations process is a crucial step in resolving claims, especially for incidents like auto accidents that require auto maintenance or auto repair services. It involves a back-and-forth dialogue between the policyholder (the insured) and the insurance provider, aiming to reach an agreement on compensation for damages, which can include costs for auto painting as part of restoration efforts.

During these negotiations, both parties present their respective cases, with the insured providing details about the incident, the necessary repairs or maintenance required, and relevant estimates. The insurance company, in turn, assesses the claim, verifies the expenses, and determines the appropriate settlement amount based on policy terms and conditions. Understanding this process empowers individuals to effectively communicate their needs and protect their interests when dealing with auto-related incidents, ensuring they receive fair compensation for any necessary auto repair services or maintenance, including auto painting, as part of their claim resolution.

– What happens during insurance company negotiations?

During insurance company negotiations, several key steps are involved as both parties aim to reach a mutually agreeable settlement for claims, particularly regarding car damage repair and auto body services. The process begins with the policyholder reporting the incident and providing details about the extent of the car body restoration needed. The insurance adjuster then assesses the damage, considering factors like repair cost estimates from qualified mechanics or auto body shops.

This assessment is a crucial part of the negotiation as it forms the basis for the insurer’s offer. They will either provide a direct payment to cover the repairs or negotiate with the policyholder and their chosen auto body services provider to agree on a fair price. Effective negotiations require open communication, where both sides discuss potential discounts, alternative solutions, and the importance of using original equipment manufacturer (OEM) parts for car body restoration to ensure quality and longevity.

– Key players involved in the negotiations process.

The insurance company negotiations process involves several key players who each play a crucial role in resolving claims efficiently. The primary participants include the insured individual or business (claimant), representatives from the insurance provider, and, in some cases, independent assessors or appraisers specialized in vehicle damage repair and car bodywork restoration.

The claimant initiates the process by filing a claim, providing details about their loss, such as the extent of car damage, repair costs, and any personal impact. Insurance company negotiators then review the claim, assessing its validity and severity. They may consult with internal experts or external specialists to accurately appraise the cost of vehicle restoration, ensuring fair compensation while adhering to policy terms.

Insurance company negotiations are a complex, yet essential, part of the claims process, involving various stakeholders. These discussions aim to reach a mutually agreeable settlement, addressing liability and compensation. By understanding the dynamics between insured individuals and insurers, as well as the roles of adjusters, attorneys, and underwriters, one can better navigate this critical phase. Effective communication and strategic planning are key to achieving favorable outcomes in insurance company negotiations.